If you haven’t yet heard about OBOR, you’re missing out on the greatest expansion of political, economic and (potentially) military influence since the ships of the British Empire set sail around the world.

China’s One Belt, One Road (hence “OBOR”) policy started a couple of years back, but hasn’t really picked up traction among investors. CITIC Securities, for one, has written extensively about it, although perhaps a good primer on the story is this transcript from a McKinsey podcast on OBOR and the accompanying effects on trade.

Why has this only caught on now? Can’t really tell, but perhaps it was because it was already known for almost a decade that the Chinese have been investing heavily in infrastructure all around the world, especially in places where no one else dares to venture: Africa and Central Asia especially. Take a trip to Kenya, and the moment you land in Nairobi, you’ll likely see a huge banner advertising for smartphones or networking equipment. The advertiser? Huawei, China’s version of Cisco Systems, Samsung, Nokia and Ericsson, all piled into one.

But I thought it would be interesting to look at two other countries in particular – not obviously related to each other, but extremely interesting.

Malaysia and Pakistan.

Why these two, one may ask? For one, they have been where China has been the most active in recent weeks. In Malaysia, Chinese investment has effectively been the bailout fund for the troubled 1MDB fund (for the sake of political sensitivities we won’t write openly about the details), with the final sum of Chinese inbound FDI into Malaysia coming up to at least US$33bn (according to the South China Morning Post).

Similarly, in Pakistan, where Chinese FDI has overtaken US FDI, along with a release from Pakistan’s IMF debt through a US$1.2bn bailout for the country. The heart of their investment plan in Pakistan is the China-Pakistan Economic Corridor (CPEC).

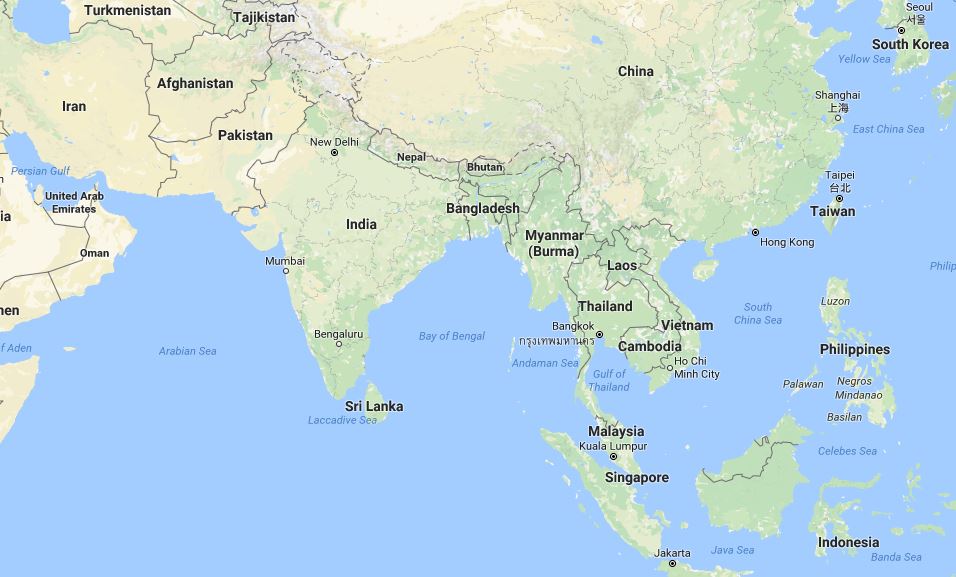

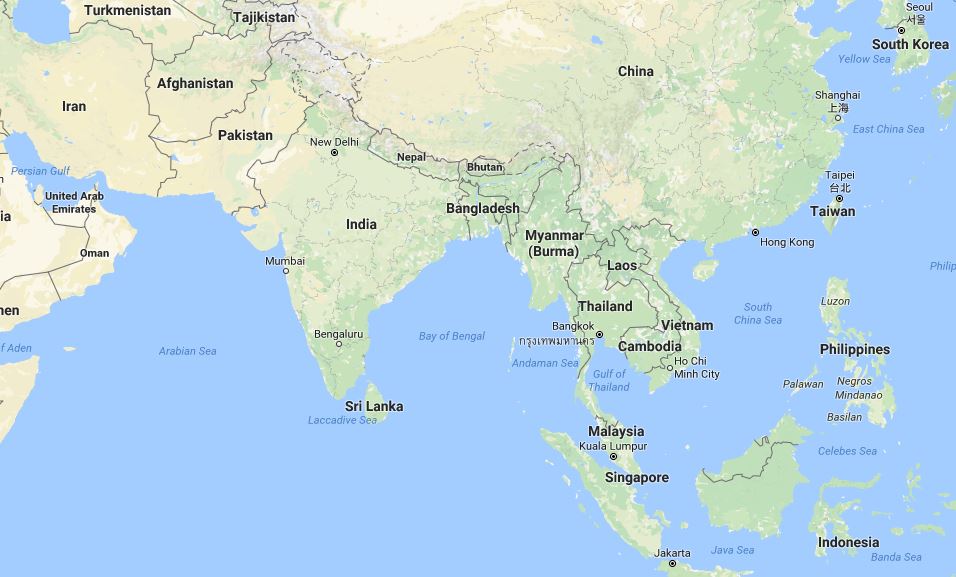

What’s the link between the two? Just take a quick glance at the world map and it all becomes clearer:

Still not obvious? Here’s the theory, and it all stems from the argument that China challenges the US for its position as the benevolent hegemon. Not familiar with the concept? An article from back in 2004 explains the idea here.

In light of a gradually retreating US foreign policy (not necessarily less interventionist, but only where it suits and protects US interests), China is seeking to fill the gap. Already its state-sanctioned ownership of key infrastructure assets, not just in emerging/frontier markets, but also in developed markets (like its successful bid for Hinkley Point in the UK), puts it in good stead to fill the gap. Its representative in that operation, in particular, is China General Nuclear (its power subsidiary is listed 1816 HK) – the same CGN which, in Malaysia, has acquired about 23% of Malaysia’s generating capacity as part of the 1MDB bailout deal for US$2.3bn.

Are they just buying because they want to own the world? Sort of, but not in the obvious sense. Look again at the map – China is effectively stuck in containment: Japan and South Korea in the East, Singapore and (to some extent) the Philippines to the South, India to the West and Russia to the North. Their expansion is bounded either by US allies or by their own long-time rivals, or at the very least, an uncomfortable former sibling during the marxist epoch.

Pakistan therefore makes the perfect partner: by investing in infrastructure and building roads, railways and ports, all the way through central Asia to the deep water port of Gwadar, China gets access to Middle Eastern oil while at the same time bypassing the traditional trade routes bottlenecked at the Straits of Malacca by a US naval presence in Singapore. Most trade gets through without a problem, but when push comes to shove, having options never hurt. Moreover, getting oil and other commodities to the Western provinces of China is quicker through the overland route than going all the way round towards Dalian and Qinhuangdao, then shipping it all inland again.

And by now their expansion in Malaysia should also make sense: the investment in a high speed rail line (the East Coast Rail Link) spans the breadth of Peninsular Malaysia, from Port Klang on the west to Kuantan on the East (where a slightly disputed port and special economic zone is being mooted), and extending up to Kelantan in the North East. Still some years away from completion, this rail link confers an obvious advantage: if ships can’t get past Singapore, they’ll just call at Klang, unload, send the cargo over land to Kuantan, and continue from there. The strategic location of Singapore, while geographically important, can be overcome.

The construction of a port at Malacca itself is also interesting: Malacca used to be a Portugese trading outpost, A Famosa, and has changed hands between the British, the Dutch and the Portugese – a brief history of Malacca here. But aside from a great cultural scene and quite awesome ondeh-ondeh, it’s hard to see any reason for ships to call at the old port, given Port Klang and the Port of Tanjung Pelapas are just North and South of Malacca respectively.

Unless the port is doubling as a refuelling point for vessels sailing into the Indian Ocean and the Andaman – rendering China free to do as they wish, projecting their presence westwards.

And that, Ladies and Gentlemen, is why Malaysia and Pakistan are important.

You must be logged in to post a comment.